How to Invest in Real Estate Without Money or Credit

Starting your real estate journey with no cash or credit can seem daunting, yet alternative methods pave the way. By leveraging wholesaling, seller financing, lease options, and partnerships, you can control properties and generate income with minimal personal capital. We’ll delve into actionable techniques for securing and monetizing property rights without banks.

To learn more about investing without cash or credit, visit: home flipping software

Innovative No-Money-Down Techniques

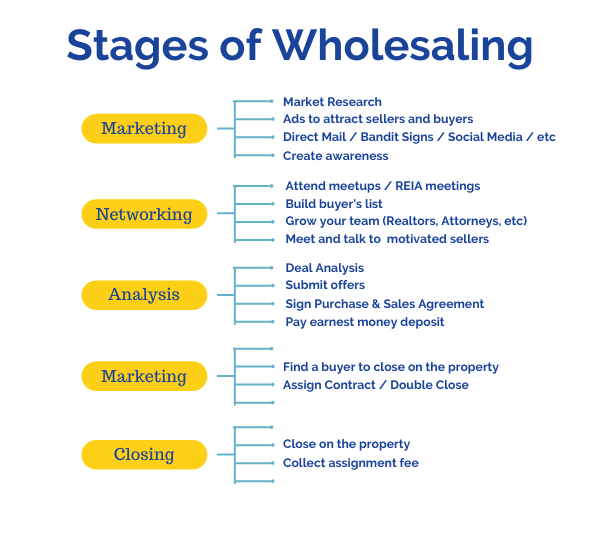

One powerful approach is wholesaling, where you secure a property contract below market value and assign it to an investor buyer for a fee. With wholesaling, no personal capital or credit checks are required, yet profits can be realized quickly. Success relies on mastering lead generation, market analysis, and negotiation skills to match motivated sellers with cash buyers.

Creative Owner-Financing and Lease-Purchase Methods

Owner financing allows you to negotiate payments with the seller, bypassing traditional mortgages. A lease-option contract locks in purchase terms while you build equity through rent credits. Both techniques let you control real estate today and buy later, often requiring little to no initial cash.

Joint Ventures & Partnerships

Joint ventures allow you to contribute market knowledge while your partner provides funding. JV contracts outline roles and revenue shares, creating clarity and trust. Clear communication, legal documentation, and shared goals are vital for successful real estate partnerships.

Essential Platforms and Insights

Using digital platforms such as CRMs and valuation tools keeps your pipeline organized and efficient. Websites and communities focused on creative financing list off-market and seller-financed properties. Resources like real estate wholesaling blog WholesalingHousesInfo.com provide step-by-step guidance and community support for leveraging creative financing.

Key Tips for Cash-Free Investing

Rigorous due diligence prevents costly surprises and ensures deal viability. A strong buyer pipeline is crucial for seamless contract transfers. Effective negotiation and honest value articulation secure profitable deals.

To learn more about alternative real estate investing methods, go to: real estate software

Final Thoughts on No-Cash Real Estate Investing

While unconventional, no-money-down techniques can yield substantial returns when executed properly. By utilizing wholesaling, seller financing, lease options, and joint ventures, you can build a scalable investment business with minimal capital. Begin with deep learning, clear paperwork, and strategic networking to embark on no-cash investing. By staying committed, honest, and flexible, you’ll transform creative financing into a thriving real estate enterprise.